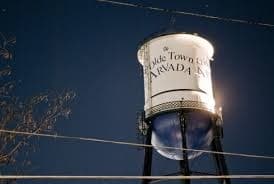

Best Local Business Brokers in Arvada -Wright Business Advisors

We are local business brokers serving Arvada Colorado, and are passionate about helping our customers achieve their dream of selling their closely-held businesses.

My family and I moved from Douglas County Colorado to Arvada Colorado in 2000, and I earned my Real Estate license and started my local business broker practice in 2005. I have owned, operated, and sold several businesses in Colorado throughout the years, and have been on all sides of the transaction as a business buyer, seller, and advisor.

Wright Business Advisors – Business Brokers serving Arvada CO, and the surrounding areas

Here are some things to consider when planning your business exit.

What Buyers look for:

Some of the top signs that you’ve built a business that’s “buyer ready”:

- You’re ready to exit and know that the business is in the best shape it’s ever been in

- It’s a profitable business with increasing revenue and profit trend that’s also paying you a suitable salary

- You have recurring revenue streams (stable, predictable, contracts)

- You have strong systems/management/team in place (not owner dependent)

- There’s a substantial growth potential (“scalable”) for the new buyer – increasing revenue while avoiding substantial cost increases

- You have good books and records (“clean” financials, procedures, strategic plan/manuals)

- You have a diverse base of customers and vendors (not having “all your eggs in one basket”)

What SBA Lenders look for in a Business:

- Adequate business cash flow to service the debt (Global DSCR or around 1.25x (1.15x min.) on all 3 years historically) Ex. $115,000 in company cash flow / $100,000 projected annual debt payments = 1.15 DSCR. They are cash flow lenders, not collateral lenders

- Pay a new buyer a reasonable salary

- No declining revenue/consecutive losses

- Personal history/citizenship

- Relevant management experience

- Good trends/growth each year – a track record of profitability and success

- The working capital needs of the business (90-day supply for the buyer’s loan)

What SBA Lenders look for in a Buyer (Guarantor):

- 700 or higher credit score

- Enough liquidity to meet the cash injection requirements (min. of 10% on the entire transaction, some allow gifts with a letter and bank statements)

- Collateral (shortfall will require life insurance)

- Experience

- Strong resume

So, if you’re looking for qualified Business Brokers serving Arvada, CO, then please consider our services. Owner, Wayne Wright can be reached at 720-436-1472 or by email at wayne@wrightbusinessadvisors.com.