- March 12, 2020

- Posted by: 145763077

- Category: Blog

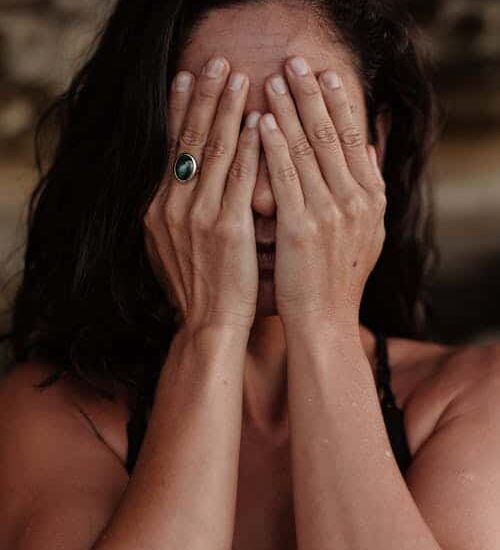

Is Uncertainty Causing You to Panic?

I’m a Business Broker Denver CO, and as of today, it appears all hell is breaking loose and reminiscent of the Crash of 1987. I don’t know about you, but I’ll admit I have a control issue and don’t like uncertainty. This coronavirus stuff has me freaked out – mostly because of the uncertainty, and I loathe seeing my stock portfolio go from the “White House” to the “outhouse” in a matter of days.

Whether we are heading into a recession now or in the future, we must remember recessions are inevitable and not necessarily a bad thing. I remember how unpleasant it was for us small business owners during the last recession in 2008. My family, our employees and I all suffered emotionally and financially for about 18 months and we learned to survive and build a lean and healthy (efficient) organization that we used a Business Broker Denver CO and sold our company seven years later for several multiples more than we paid for it.

Contractions and expansions are a part of the normal economic cycle and when we have negative economic growth, recessions help keep inflation in check and provide buyers an opportunity to invest again.

The coronavirus pandemic is concerning and no one wants to acquire a respiratory virus that poses a threat to our lives – especially those with weakened immune systems. Hopefully, this disease will never come close to the devastation seen by the Asian or Spanish flu, the bubonic plague, the HIV virus, or the swine flu, and from what I understand thus far, it is not. In times like this, I understand that God is in control and not me. In the last 25 years in business, we’ve gotten through a variety of horrific events, terrorism, and The Great Recession, and I’ve seen our country pull together and where heroes and leaders emerge to rise to the occasion. Yes, businesses were negatively impacted then, and are being negatively impacted now. Whether or not we are in our current organizations in another year from now, we will make it through this moment in life and things will eventually be okay. Let’s continue to pull together and help lift each other up and rise to the occasion.

You may ask, what can I expect if I want to move on and sell my business. Just as I have often used the wrong “crystal ball” to prognosticate when to move in and out of the stock market, I honestly don’t know if the timing to sell your business is as good now as it was last year? I certainly hope so. As it probably makes sense to hold onto our stocks if we haven’t exited the market by now, if we’re not anxious to sell now, maybe we should consider making our businesses more efficient and add more of the drivers that increase value and sell at a later date once things settle down a bit?

We must consider the potential impact of the coronavirus on business valuations. Buyers and lenders evaluate risks associated with a business acquisition in addition to other factors, and unfavorable economic growth projections negatively affect a company’s growth forecast. Also, when revenues, profits, and the cash flows of our businesses decline, business values decline. Of course, businesses with more value drivers will sell for higher multiples as they reduce investors’ risk.

I will tell you at the beginning of this year, Business Advisors expected a healthy mergers and acquisitions market with 55% of advisors predicting the volume of deals (under $50 million) would increase in 2020 over 2019.

As unsettling as all of this may be, keep working on your business and remember “This too shall pass.” We as humans tend to have short memories and will forget the pain, we’re currently experiencing.

“As sure as the spring will follow the winter, prosperity and economic growth will follow recession.”

– Bo Bennett

If you want to discuss your situation, reach out to me at your earliest convenience.